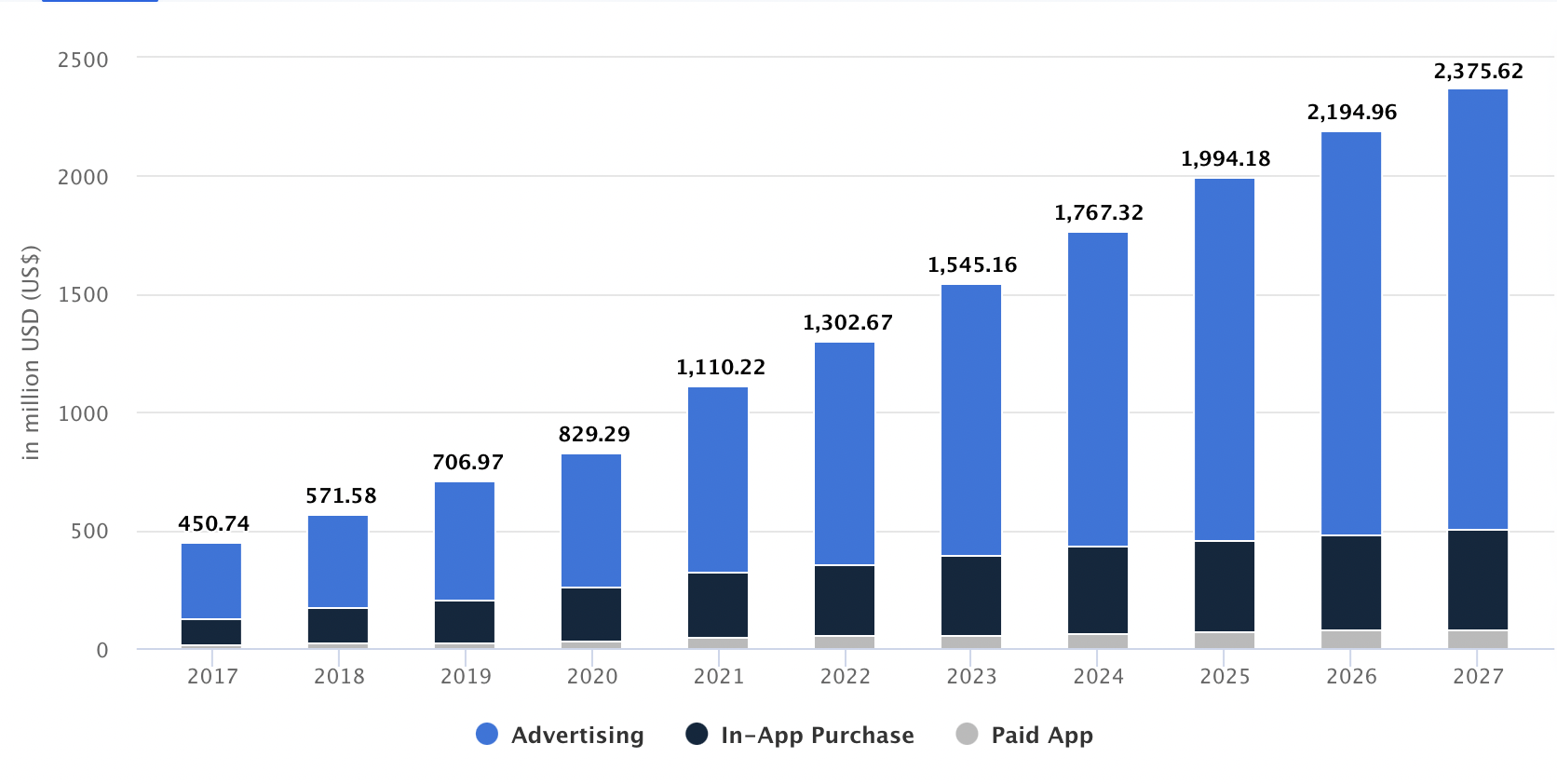

Retargeting for finance apps can be a challenging task. With privacy issues and other trust and safety concerns at the forefront of finance app users' minds, gathering consumer data for these apps can be difficult. However, the finance app market is extremely lucrative post–pandemic due to many banks and other financial institutions switching to mobile friendly platforms. In-app purchases for finance apps reached a staggering $301.7 million in 2022 and are expected to keep growing as we move into the second half of 2023.

Source: Statista

Despite the challenges that come with growing finance apps’ user bases, retargeting can still be an effective tool when approached strategically and ethically. Finance apps should focus on building trust with their users, ensuring compliance with regulations, and using retargeting to provide relevant and valuable content. Here, we give the top tips for growing a loyal user base for your finance app using retargeting.

How to Retain Loyal Finance App Users

Financial apps are becoming increasingly popular as financial institutions look to create fully digital experiences for their users. In Europe there has been a 72% rise in the usage of fintech apps since the beginning of the lockdown. These apps have become essential for businesses and users alike, enabling convenient and secure digital payments and banking. In order for app marketers to retain their user base, it’s essential to streamline the onboarding process, double down on security messaging, offer referral or loyalty programs, and personalize communications based on user behavior.

Streamline the Onboarding Process

Successfully onboarding app users is one of financial services companies' biggest challenges. One in two consumers currently uses a mobile-friendly finance service, however 77% of the daily active users abandon an app after just 3 days. This makes the onboarding journey a critical component of user retention. Creating a user-friendly, stand-out onboarding experience is key to winning over new fintech app users and retaining them for the long haul.

The key to a streamlined onboarding process starts with a fast sign-up process. Letting the user create a profile quickly so that they can start to browse the platform will limit drop off due to too much leg work on the front end. Marketers can utilize deep linking to send new finance app users directly to their app from an advertisement or email. Many users are new to banking or paying through an app, so simplifying the user experience with quick sign-up will help them feel more comfortable. Utilize chatbots or other methods of communication with the new user to make sure there is a way they can troubleshoot issues or answer questions instantly. Marketers can also provide interactive tutorials and guides to help users understand the app's features and benefits and encourage them to keep using the app. The first few days are crucial when it comes to creating loyal finance app users!

When users have a positive onboarding experience, they are more likely to continue engaging with an app. This improves user engagement and retention, which in turn drives revenue. A smooth onboarding experience creates a higher chance of converting users into paying customers and increasing their lifetime value.

Emphasize Security and Safety

With finance apps specifically, it’s extremely important to establish a sense of trust and security with users as quickly as possible. App marketers can do this by pushing out messaging around safety precautions. For example, if a finance app is offering two-factor authentication as a way to keep user’s data secure, marketers should emphasize that in their advertising copy. Many users still have fear when it comes to putting their well-earned money in the hands of an application. Making sure consumers know the high level of security and precautions your brand takes will increase engagement and overall revenue.

However, growing and engaging new users for finance apps differs based on whether or not they have existing desktop platforms in place. Banking apps that have an existing desktop product already have an engaged audience. Therefore, the emphasis for these users should be on continued cyber-safety and support. These consumers might be hesitant to deviate from a platform that they are already familiar with. App marketers need to emphasize safety and trust within the app during the initial onboarding process.

With financial apps that are mobile-first, messaging should be centered around how mobile security works. Making sure that users know their information is being stored properly, just as it would be on a desktop platform is important for the longevity of users. If consumers don’t trust the product, they will not continue to use it. App marketers can allow users to demo the platform for free before subscribing in order to prove the safety of the app.

Referral Programs

Referral programs work exceptionally well for finance app engagement. People tend to trust recommendations from their friends, family, or colleagues more than traditional advertising. Referral programs leverage this social proof, as users are more likely to try or re-engage with an app when it's referred by someone they know and trust. Additionally, referred users are often more relevant and likely to engage with the app since they are typically introduced by someone who knows their interests and needs. This higher level of engagement improves overall user retention rates.

For example, PayPal used a referral strategy to boost their user acquisition and retention. They offered $20 to anyone opening a PayPal account, with an additional $20 if the person you referred opened an account. The initiative was a huge success because in order to make use of that free money, people had to actually open and use a PayPal account. This encouraged current users to keep using the app because they were excited about more rewarded initiatives. App marketers can engage lapsed users by promoting referral programs and leveraging this peer-to-peer communication.

User Loyalty Rewards

Another way app marketers can strengthen the bond with their audience is by introducing a loyalty program. Loyalty programs offer users tangible rewards, such as discounts, exclusive offers, cashback, or loyalty points. These incentives provide a strong motivation for users to continue using the app and engaging with its features. Satisfied users who benefit from loyalty programs are also more likely to share their positive experiences with friends and family. This word-of-mouth marketing can lead to new user acquisition through referrals.

A great example of leveraging user loyalty for continued engagement is with credit card points. Users have an increased loyalty to one company when they are incentivized to spend in order to earn later. Regularly engaging with the app to accumulate loyalty points can lead to habit formation. Users become accustomed to using the app regularly, which strengthens their loyalty and reduces the likelihood of churn.

Loyalty programs also allow app marketers to collect valuable user data and insights. This data can be used to better understand user behavior, preferences, and pain points, leading to better targeting of future rewards. Marketers can personalize incentives or ads to these users based on their spending habits or actions within the app.

Personalization

In order for finance apps to engage with users who have gone quiet, app marketers can provide personalized content, recommendations or offers. Users are more likely to engage with content that matches their tastes and habits. Finance apps have access to extremely granular data such as where consumers are spending the most and at what times. In order to re-engage with users at a personal level, app marketers can use this data and make recommendations based on those habits.

Different generations of consumers use finance apps in unique ways. Gen Z’ers, for instance, may be just kick starting their savings goals. Whereas Baby Boomers may be looking for new places to invest their savings before retirement. Based on these factors alone, marketers can tailor ads differently in order to capture the attention of their audiences.

Takeaways of Retargeting for Finance Apps

Despite the challenges that come with growing finance apps’ user bases, retargeting can still be an effective tool for finance apps when approached strategically and ethically. It’s essential for finance app marketers to streamline their onboarding process, double down on security messaging, offer referral or loyalty programs, and personalize communications based on user behavior.

- Streamline the Onboarding Process: When users have a positive onboarding experience, they are more likely to engage with an app. A smooth onboarding experience drives a higher chance of converting users into paying customers and increasing their lifetime value.

- Emphasize Security and Safety: With finance apps specifically, it’s extremely important to establish a sense of trust and security with users as quickly as possible. App marketers can do this by pushing out messaging around safety precautions.

- Referral Programs: Referral programs work exceptionally well for finance app engagement. People trust recommendations from their friends, family, or colleagues more than traditional advertising.

- User Loyalty Rewards: Loyalty programs offer users tangible rewards, such as discounts, exclusive offers, cashback, or loyalty points. These incentives provide a strong motivation for users to continue using the app and engaging with its features.

- Personalization: In order for finance apps to engage with users who have gone quiet, app marketers can provide personalized content, recommendations or offers. Users are more likely to engage with content that matches their tastes and habits.